PANAMA PAPERS: PAY ATTENTION

When you think of obtaining wealth or growing your business in order to build your legacy, where do you usually save your money? Do you open up a trust account, a business account, invest in CD accounts (Certificate of Deposit) or do you use the old fashion way from your grandmother's lips; mattress money?

With the recent controversy around the leak of a list of names from the Panama Papers, many are looking into how many individuals invest in making sure their assets are protected in offshore accounts. The Obama Administration have been working on proposals to eliminate such activity.

The states of Delaware, Wyoming and Nevada are mentioned as some of the gateway to setting up offshore accounts. It is very possible to "shield" your assets when you participate in offshore activity which some also called it "shelter accounts". If you are a United States citizen, you are aware of the various state laws and national tax laws on businesses as well as individuals. Offshore accounts can serve as the safe haven preventing you from such taxes.

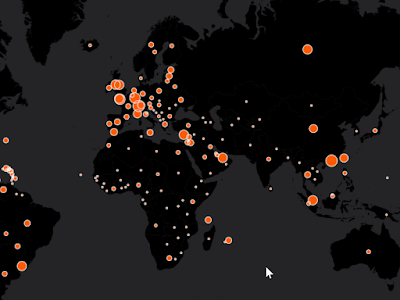

Offshore accounts is a global issue but has grown drastically over the years due to the increasing wealth of the elite which includes celebrities in many genres along with individuals who obtain wealth from generation after generation. Protecting your assets is one thing but avoiding taxes by using an offshore account can be viewed as lascivious.

The top countries that have been named in offshore account activity of individuals along with businesses are British Virgin Islands, Hong Kong, Switzerland and United Kingdom. As long as there is wealth in the world, it will be nearly impossible to obtain all activity that takes place overseas outside of the United States. If you are investing and have a monetary flow that will require you to pay hire taxes, hire a tax attorney or a financial consultant to help you manage your portfolio of assets. Read more about offshore accounts here.

Comments

Post a Comment